Crypto-assets trading activity under French laws

Mainly based on speculation, crypto-assets are increasingly becoming the purpose of alternative finance despite a blurry legal environment. Traders use many strategies, from the most basic to the most advanced, such as technical analysis, copy trading or bot trading. Some of them make trading their business by offering services to third parties. As a result, this activity is not exempt from tax and legal regulations.

Trading can be made by amateur or professional individual traders.

The former carry out this activity on an occasional basis, on their account and generally alongside their main activity (study, employment, retirement, etc.). They operate within a simple legal framework: no particular regulatory obligations and taxation at 30% flat tax on capital gains (see the white paper of Waltio).

The latter are facing a more complex legal environment but dispose of several options to ensure their regulatory and tax compliance.

The regulatory framework for professional trading

The key opposition lies in whether the activity is executed on its own account or behalf of a third party.

Trading in crypto-assets for own account is unregulated under French law.

However, the management of a client’s crypto-assets trading account corresponds to the service of “portfolio management of digital assets on behalf of third parties” within the meaning of the French Monetary and Financial Code.

More specifically, this service refers to “managing, in a discretionary and individualised manner, portfolios including one or more digital assets under a mandate given by a third party”. For instance, it aims the activity of access to a client’s Kraken account (via API) to place orders on his behalf.

This service is not subject to mandatory registration as a Digital Asset Service Provider (DASP) as long as it does not implies the custodianship of the crypto-assets of the client, nor a cash-in or cash-out fiat service. Players seeking a level of regulatory compliance similar to traditional financial intermediaries can apply to the AMF for optional PSAN approval.

As an individualised service, portfolio management does not cover the collective management of digital assets, which falls under the regulations applicable to investment fund or investment management company.

Lastly, if portfolio management does not fall under specific regulatory obligations, it does not exempt the conscientious service provider to:

- structure its activity within a company ;

- implement a strong contractual framework (management agreement, etc.) tailored to the crypto-assets market;

- comply with consumer law (pre-contractual information, the prohibition of unfair and misleading practices, jurisdiction, etc.) which remains fully applicable.

Taxation if crypto-assets trading incomes

Professional or individual traders, as well as clients of a portfolio management service, remain liable for their tax obligations.

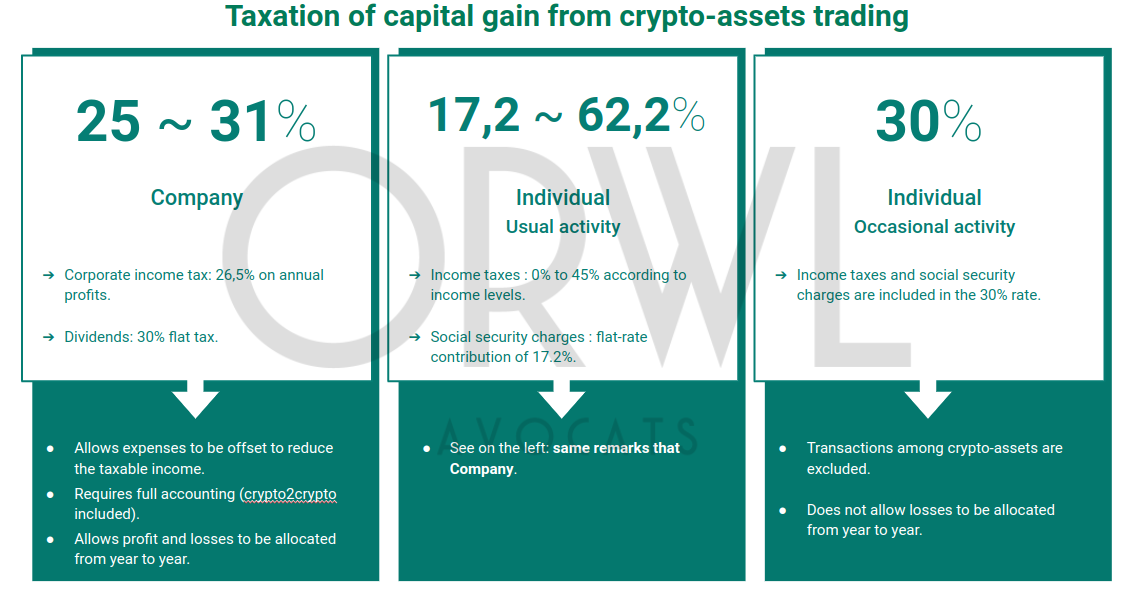

The tax regime depends on whether the trading activity is carried out as a company or as an individual and whether it is conducted on an occasional or regular basis:

- company’s income – whether the trading activity is carried out on own account or behalf of third parties – will be included in the turnover; expenses may reduce the result subject to corporate income tax;

- individual income – whether the trading activity is carried out on own account or behalf of third parties – will be subject, for an occasional activity, to the flat tax of 30% applicable to capital gains on digital assets and, for a usual activity, to the BIC regime following the progressive scale of tax on income.