Click & Bid: how to sell NFTs in France ?

The French voluntary auctions sales council (conseil des ventes volontaires de meubles aux enchères – “CVV”) recently published a report (in French only) assessing the situation of the NFTs’ market and the opportunities offered for the auction sector.

What are the various auction categories in France ?

According to a definition provided by the French legislator, “public auctions consist in submitting a good to a competitive public tender, won by the highest bidder, designated as the tenderer, based on the predefined auction’s terms”.

Following the Law of July 10, 2000 and the adjustment of French Law to European rules of free movements of services, public auctions have been liberalized (beforehand auctions were reserved for the profession of auctioneers).

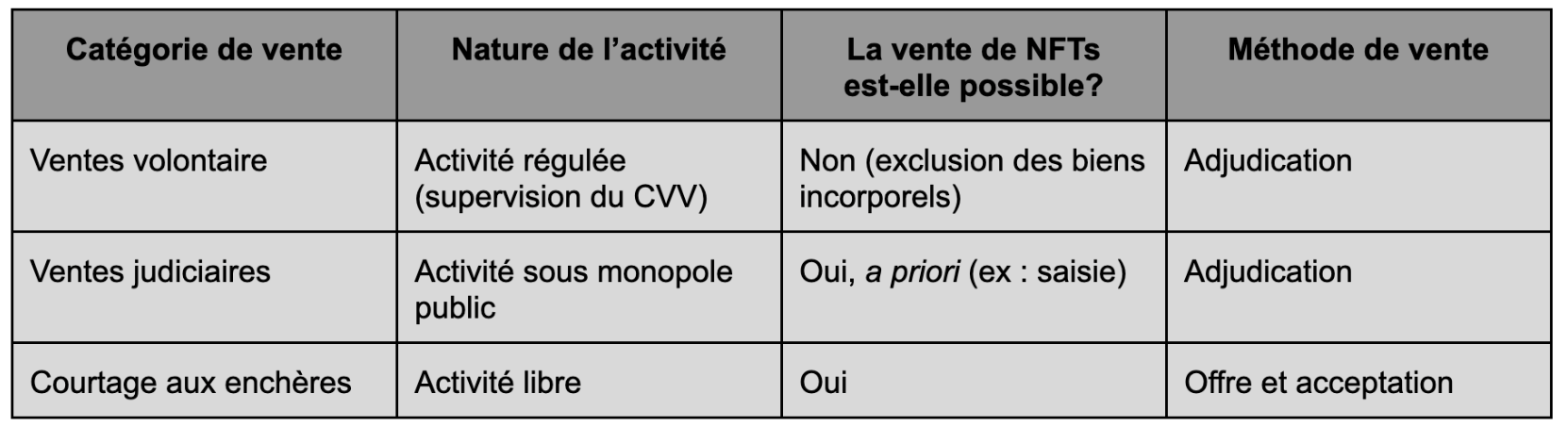

In France, there are two main activities : “judicial” sales and “voluntary” sales, coexisting with the activity of “bidding brokerage via electronic means”, which isn’t regulated.

Judicial sales

Judicial sales (e.g. judicial liquidations, sales of seized properties) are sales that are prescribed by law or by a judicial decision.

Those sales are operated as part of the public service of justice and are reserved for specific professions (e.g. judicial auctioneers, notaries, bailiffs).

Judicial sales include all forced sales, as well as some other categories such as sales completed as part of an inheritance.

Voluntary sales

Voluntary sales refer to “sales involving a third-party, acting as the agent of the owner or as its representative, in order to offer and award a good to the highest bidder, following a competitive public and transparent tender” (article L.320-2 of the French Commerce Code).

Essentially, this category includes regulated auctions for which the parties voluntarily submit to the terms and process of the sale. Such sale is formally concluded by the sales operator via a bidding process. It is traditionally operated in auction houses open to the public, but they can also be completed online, in which case the same rules will apply.

Since the Law of July 10, 2000 voluntary public auctions of movable property are almost entirely reserved for voluntary sales operators, which are commercial companies or natural persons that must meet the specific requirements set forth in article L.321-4 of the French Commerce Code.

Voluntary sales must be declared to the CVV, the regulating body of this sector, which is not fully an independent administrative authority but acts as a traditional regulatory authority.

The operation of a voluntary public auction within the meaning of article L.320-2 of the French Commerce Code, without prior declaration to the CVV, or without satisfying to the legal conditions (set forth in article L.321-4 of the French Commerce Code) is sanctioned by two years of imprisonment and a fine of €375.000.

Bidding brokerage

Alongside judicial and voluntary sales, “bidding brokerage operations via electronic means” must also be recalled. This activity is characterized by “the absence of tendering to the highest bidder and the absence of involvement of a third-party in the property’s description and conclusion of the sale” according to French laws.

Essentially, online bidding brokerage operations merely consist in applying functionalities allowing the buyer and the seller to perform auctions, without conclusion by the broker, unlike for a voluntary sale.

The frontier between brokerage activity and the regulated activity of voluntary sales is sometimes delicate. For example, following a legal action introduced by the CVV, French courts judged that the activity of eBay fell within the scope of brokerage, mainly because the website allowed the buyer to make an offer that the seller was always free to accept or to reject, before irrevocably concluding the sale.

From a strictly legal point of view, French courts have ruled that in the course of a bidding brokerage, the seller is the one making an offer and the buyer is the one proceeding to an acceptance, as opposed to a voluntary sale where the operator issues an offer on behalf of the seller, which is accepted through “hawking” by the highest bidder.

The analysis has been confirmed by the French Court of cassation, which judged that the activity of a company performing online auctions of second-hand vehicles was not a regulated activity since the buyer needed to “proceed, without any intervention of the company (…), to confirmation of its consent, in such a way that the good offered for sale was not awarded at the end of the bidding, and the bidder remained free not to contract”.

Even though bidding brokerage is not regulated, as opposed to voluntary sales, there is still a legal regime applying, mainly through consumer information.

How do NFTs auctions blend in the French legal framework?

Are judicial NFTs auctions possible?

Although the legal classification of NFTs is uncertain (see our article on the possible classification of NFTs under tax law), there is no legal rule prohibiting the sale of NFTs within a judicial sale subsequently to a criminal seizure in France.

This seems even more possible that an official body, the agency for the administration and collection of seized and confiscated assets (Agence de gestion et de recouvrement des avoirs saisis et confisqués – “AGRASC”), performed a bitcoin auction in March 2021, following a seizure by the Paris Public Prosecutor.

NFTs don’t have the same characteristics as bitcoins (notably, they aren’t “fungible” even though this technological point may be discussed), but they rely on similar technologies so it’s possible to consider that the French State could perform a NFT auction, just as it performed one on bitcoins. This actually already happened in the UK.

Some NFTs collections such as the Bored Ape Yacht Club or the Crypto-Punks have entered the pantheon of crypto-art, exposing their owners to potential fraud of theft (see for example this BAYC owner that has been robbed 2.2 million dollars worth of NFTs). Those NFTs will be prone to criminal seizures following an investigation.

Voluntary sales: a legal impossibility to perform NFTs auctions

The CVV report stated that “to this day, [French] law doesn’t allow auction operators to organize NFTs auctions in France, because NFTs are intangible assets”.

Indeed, article L.321-2 of the French Commerce Code provides that “are deemed movable property […] the movable properties by nature”.

This provision only concerns tangible movable property, aimed at article 528 of the French Civil Code. Intangible assets and immovable property are thus excluded from the scope of voluntary sales.

This limitation is all the more detrimental that resorting to voluntary sales operators for an auction shows several advantages. For example:

- Authenticity: although blockchain technologies allow to guarantee the NFTs authenticity and aim at getting rid of intermediaries, there’s still an uncertainty due to the several scams and frauds on most popular collections. The use of professionals would increase the legal security for major transactions.

- Technicity: selling and buying NFTs isn’t an easy practice when it comes to the underlying tools and technologies. The charge and responsibility related to the ownership transfer could be delegated to professionals. Just as investment funds such as Grayscale, which allow investors to invest in crypto-assets without buying or owning it, voluntary sales operators could allow institutional stakeholders, affected by the complexity of technologies, to position themselves on the purchase of NFTs.

- Outreach: due to the reliability and renown of auction houses, their entry on the NFTs market could contribute to the development of NFTs and to the use of this technology, which already quite happened.

While the US-British auction house Sotheby’s already decided to invest on NFTs sales in the metaverse, the restrictive French regulation is a serious impediment to the development of French auction businesses. French law could benefit from some modifications in order to allow French operators to perform NFTs’ sales.

This may be the reason why the French Parliament is considering the suppression of this limitation and the extension of the legal regime of public voluntary sales to all movable properties and de facto to intangible assets, in a draft law of the Senate for the modernization of the regulation of the art market (in French only).

Bidding brokerage and NFTs

Today, most NFTs sales platforms are using bidding mechanisms that may fall within the scope of bidding brokerage, such as OpenSea.

More fundamentally, regardless of the legal definition of NFTs, those platforms are first and foremost subject to consumer law, including the provision of pre-contractual information which are listed at article L.111-1 of the French Consumer Code in France (e.g. “the essential characteristics of the relevant service”, “the features of the digital content and, as the case may be, its interoperability”).

Within the meaning of French law, the bidding brokerage legal regime also includes:

- article L.321-3 of the French Commerce Code, which provides that the platform making available to a user “an infrastructure allowing the organization and performance of bidding brokerage through electronic means must inform the public of the nature of the proposed service, in a clear and unambiguous way”. The breach of this obligation is sanctioned by a €15.000 fine for natural persons and €75.000 fine for legal persons.

- the obligation for the operator to provide consumers with specific information on “cultural” goods, even though this category is not precisely defined.

Key points

The issue for marketplaces is to avoid the assimilation of their services to voluntary sales, which are regulated, because the legal regime of bidding brokerage is less rigorous since it is only regulated by consumer law.

Taking into account the aforesaid case law, it seems important that the buyer gets the choice whether to conclude the sale after the auction reaches the price set by the seller.

However, smart contracts technologies allow sellers to ensure that the sale is automatically concluded if the fixed price is reached and if the fixed time for the sale has elapsed (“English Auction”), meaning that the seller is making the offer and the buyer accepts it, by fulfilling the conditions of the sale.

Smart contract technologies are brand new which means that it is very hard for anyone to take a stance on whether an online NFT auction on a marketplace may qualify as a regulated auction. There is no doubt that the first court decision will be very interesting for all stakeholders.