DeFi : Legal and tax issues of decentralised finance

Decentralised finance, DeFi or open finance, is a natively digital financial system, based on decentralised and open computer protocols, relying on blockchain technologies that guarantee the security, immutability and incensurability of transactions.

As crypto-assets have for the first time made possible the exchange of value online – just as the Internet has made possible the digital exchange of information – decentralised finance aims to take advantage of these developments by reproducing traditional financial mechanisms in a purely and natively digital context.

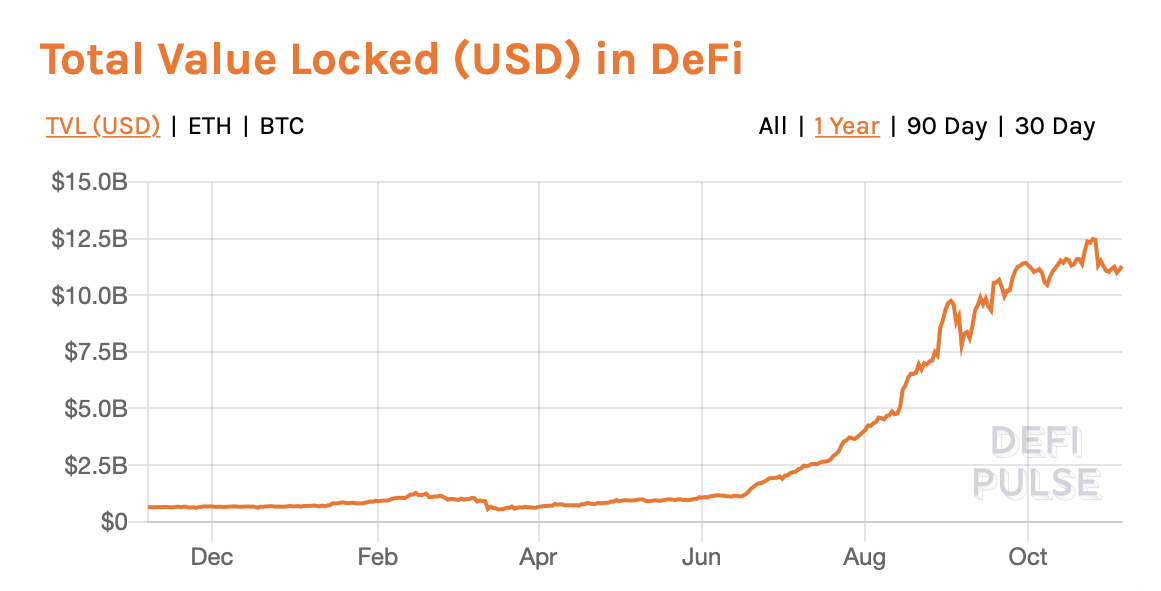

Since the beginning of 2020, the value of digital assets deposited in DeFi project smart contracts has grown exponentially to exceed $12 billion.

Open by nature, DeFi’s philosophy is interoperability. Each project leader builds his service but at the same time brings a new brick to the technological and financial edifice of the ecosystem. Each protocol layer thus constitutes a sort of lego that can be combined with another to build a new service.

For example, MakerDAO has created the stablecoin DAI, which is a stable value; Compound allows you to lend or borrow DAI against interest; rDAI allows you to separate the capital from the interest, and so on.

Today, more than 250 active DeFi projects are listed by DeFI Prime, the vast majority of which are on the Ethereum blockchain, which brings the number of possible combinations between the different bricks to several million and thus hints at an exponential rate of innovation.

However, each brick brings its own set of legal and tax issues, each more complex than the last: loans, interest, liquidity mining or farming, copy trading, stablecoins, swaps, synthetics, insurance, airdrops, etc.

If the sector still remains confidential and by nature difficult to capture by law due to its characteristic pseudonymity and decentralisation, the past has shown that no project could escape the regulator and no user was immune from the tax authorities, whether it be The DAO for ICOs, Libra for stablecoins or more recently, Bitmex for derivatives.

This is why we propose, in a series of short articles published every week, to provide you with an update on the French legal and tax issues of each of the main bricks currently making up the DeFi ecosystem.