Foreign crypto platforms: watch out for lawsuits in Europe

While France has a dynamic ecosystem in the crypto sector, the main global platforms offering services on digital assets are foreign.

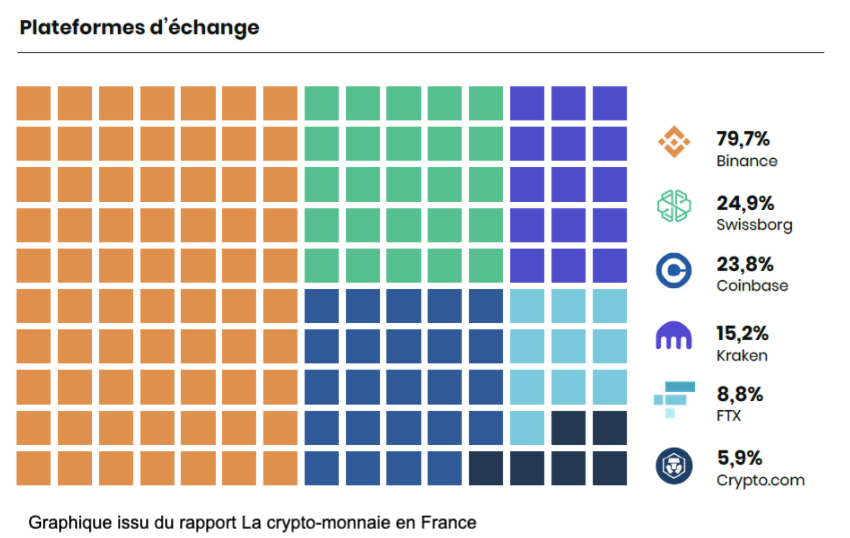

In a recent report on digital assets in France (“Crypto-currency in France”, Cryptocheck, 2021, pp. 12-13), the information website CryptoCheck reveals that among the six most used platforms in France, all of them are foreign and none of them has a head office on French territory.

Despite the undisputed dominance of non-European platforms in the French investor market, none of them has – as of the date of this article – been registered or licensed as a digital asset service provider by the Autorité des Marchés Financiers.

⛔ Deterrent dispute resolution clauses for European users

Most foreign platforms have included in their terms and conditions either arbitration clauses for the benefit of institutions located in Asia, or jurisdiction clauses for the benefit of courts located in the jurisdiction of their world headquarters.

These clauses generally provide for an applicable law as well as a jurisdictional competence different from the country of residence of the customer when the latter is domiciled in a Member State of the European Union.

The dissuasive effect of this type of clause for French and European customers is obvious when it implies the need to deal with a jurisdictional system that is often unfamiliar and in a different language. This results in the need to seek local legal advice with the associated costs.

Thus, in the great majority of situations, in particular when the amount of the damage is quite low compared to the cost of an international procedure, these jurisdictional clauses prevent the initiation of civil legal proceedings, and clients stop at the stage of amicable pre-litigation procedures.

👥 The consumer approach as a possible circumvention of jurisdictional clauses

In a very recent decision rendered in a dispute between an individual resident in France and a foreign platform, the Montpellier Court of Appeal opened the door to the jurisdictionalization of disputes between exchange platforms and French users in favor of French courts (CA Montpellier, 2nd ch. civ., October 21, 2021, n° 21/00224).

Based on the provisions of the Brussels 1 bis European regulation, the French court relied on the notion of consumer to justify the competence of the French courts to settle a dispute between a foreign platform and a French user, even though the terms of use of the platform expressly provided for a jurisdictional clause in favor of the courts of a foreign country.

To justify its jurisdiction, the court relied on the provisions of the above-mentioned European regulation allowing any person having the status of consumer to bring an action in the jurisdiction where he/she is resident, regardless of the residence of the other party.

Thus, despite the jurisdiction clause provided for in the contract binding the platform to the user, as a consumer, the latter retains the possibility of suing the platform in the country in which he is domiciled.

On the contrary, the user qualified as a professional cannot avoid the jurisdiction clause provided by the general conditions of the platform.

However, it should be noted that the court made a particularly broad assessment of the notion of consumer on this point. This quality is recognized even when the user in question had invested particularly large amounts, performed several hundred transactions and was involved in the development of a Blockchain project involving digital assets.

🌍 The necessary condition for the operator to conduct its commercial activities in France

In these circumstances, as with the regulation of digital asset service providers, the only way for platforms to escape the jurisdiction of the French courts is to demonstrate that their economic activity is not directed towards the French market.

Indeed, the Brussels 1 bis regulation only makes this jurisdiction clause favorable to consumers enforceable against operators who conduct their activities in one or more Member States of the European Union.

The concept of “directed activity” thus makes it possible to include digital activities and to subject to European Union law operators who are not established in the European Union but offer their goods or services to consumers located in the European Union.

The mere accessibility of a website in Member States other than the one where the business is established is not, in principle, sufficient to characterize the intent to establish commercial relations with consumers.

The criteria set out by the Court once again appear to be flexible enough to consider that an online operator is offering its services to a Member State. These criteria include the following:

- a statement that the service is available in the state in which the consumer is located;

- incurring referral expenses to facilitate access to the service in the state in which the consumer is located;

- the use of neutral top-level domain names such as “.com” or “.eu;

- the use of the euro.

The criteria for targeting a member state’s market therefore appear relatively easy to characterize.

Under these conditions, it is up to the platforms that do not wish to be able to be sued before the French courts by their users to take the appropriate measures to minimize the risk of being considered as directing their activities to France.

ORWL Avocats is at your disposal to discuss this matter and to assist you in implementing remedial measures and developing an appropriate litigation strategy.